Special Muni Catchup on Q2 & Q3

by PL

Q2: Duration Was the Bond Investor’s Friend

Q2: Duration Was the Bond Investor’s Friend

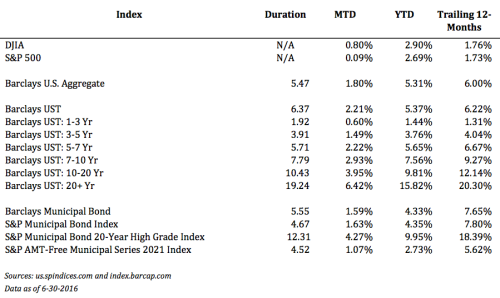

Some of the total returns earned this year in the bond market are the envy of equity investors. Generally speaking, duration was the winner, as shown by the select indices shown below, the higher the duration–the higher the total return. While buy and hold investors are less concerned about total return (as they tend to be long-term investors, rather than tactical asset allocators), they will likely be excited to see the quarter-end values of their existing holdings to be much higher because of the decline in rates.

Q3: Check Your Calls & Beware the Coupon

One of the quirks of the municipal bond market is that unlike the U.S. Treasury market, there is not a comprehensive standard yield curve that can truly represent trading activity. This is not for a lack of effort, as there are in fact some excellent benchmark yield curves to describe the muni market.

However, since most muni CUSIPs don’t trade on a regular basis (in a typical quarter, over 95% of all muni CUSIPs don’t trade at all, according to recent MSRB data), writing a curve every day requires interpolations and extrapolations based on actual trading data and assumptions–such as what kind of coupon rate (par or premium), call structure, general market or specialty state, ratings, etc. The assumptions will vary according to what the benchmark is used for. As a result, depending on whom you ask, you may hear that the MMD scale is the best, or MMA, or Bloomberg, or another scale.

Above: the Bloomberg 30-year muni spot yield closed June 30 at 2.176%, down from 2.657% on 3/31.

No matter which benchmark yield curve you look at, however, muni yields in the second quarter dropped by a lot, and at the longer end of the yield curve, they dropped by more than U.S. Treasury yields. (See the Yield Trend Table.)

In addition to the seasonal demand driven by the heavy Summer Redemption Season, there seems to be an increase in the long-term trend (sometimes referred to as secular trend) of money flowing into munis. As shown on my Municipal Bond Fund Flows table, the year to date flows into mutual funds and ETFs is much heavier than in the last two years.The cause is difficult to know with certainty, but intuitively the trend makes sense as retiring and retired baby boomers need to replace their earned income with investment income, and even at low yields, munis do generate a reliable fixed amount of income until maturity.

The Bottom Line for Q3:

Check Your Calls: So, what’s my takeaway about all this? Because of the dramatic decline in muni yields, the arithmetic of refinancing older munis has gotten better for issuers (whose interests are opposed to investors). In other words, older callable bonds that are valued at a premium are at an increased risk of being called away–just as the reinvestment options have become less attractive.

While this doesn’t mean that you should sell callable bond holdings, it does mean that you should only add additional callable premium bonds after evaluating the concentration of call risk in your portfolio. It would also be sensible to evaluate what you would do if your callable bonds were called at their next call date.

Beware the Coupon: While the 5% coupon has been the favored structure for issuers (and institutional investors) for many years, the relentless decline in rates means that dollar prices have also marched higher and higher to the point that in many cases they have gotten uncomfortably high even for some professional investors. Favoring par bonds now may not be a prudent move for investors, though, because of the potential exposure to the unfavorable tax treatment on market discount should rates move higher. Except for a small exclusion, the market discount realized on the sale of municipal bonds is subject to taxation at the holder’s ordinary income tax rate–not the capital gains rate. So if rates move higher and today’s par bonds are sold at a discount in the future, subsequent bidders will lower their bid prices to make up for the more onerous taxation of the market discount that would have to be paid by the subsequent holder. If you are a buyer, beware of the coupon rate (and the dollar price) on new purchases. Continue to favor premium bonds–to reduce the risk of bonds moving to a discount if rates move higher.

Pay Attention to Duration: As uncertainty clears and some of the recent flows into bonds reverses, higher duration bonds and indices will be expected to underperform the rest of the bond market. So while it may be tempting to put new money to work where performance has been the strongest (in long-duration bonds, funds or ETFs), we all know that past performance is not an indicator of future returns. When the market turns, duration will be the total return investor’s foe. Unless you are an active total-return investor prepared to react quickly to market changes, new money should be put to work in line with the long-term goals as defined by your investment policy statement.

Puerto Rico: You all know what’s going on with Puerto Rico, so I will spare you any additional discussion, but do see Caveat Emptor in the June 27 Muni Catchup if you haven’t read it already, and visit Bloomberg.com for the up-to-the-minute news.

I’ll be back on Tuesday with the next regularly scheduled edition of The Muni Catchup. Best wishes for a safe and fun Independence Day holiday.

Thanks for reading,

Pat

PS–When was the last time you sat down and read our country’s founding document? Independence Day is a good time to do that. One old friend is in the habit of reading it out loud for his family and friends before the traditional dinner of hamburgers and hot dogs is served. Do you have a similar tradition? Maybe it is time to start one.

When, in the course of human events, it becomes necessary for one people to dissolve the political bonds which have connected them with another, and to assume among the powers of the earth, the separate and equal station to which the laws of nature and of nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are life, liberty and the pursuit of happiness. That to secure these rights, governments are instituted among men, deriving their just powers from the consent of the governed. That whenever any form of government becomes destructive to these ends, it is the right of the people to alter or to abolish it, and to institute new government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their safety and happiness.

Click here for a 2-page PDF of the Declaration of Independence.

PPS–Have you printed out The Summer Thinking Lists for yourself and your clients? Come on, don’t make me come down there and print them for you!

The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice–this is not investment advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

©2016 Patrick F. Luby

All Rights Reserved

[…] In addition to my concern about being cautious about investing in the most liquid parts of the muni market, I stand by my closing thoughts from last week’s Catchup: […]

LikeLike