Caution!

Year-to-date, most muni indices are still strongly in positive territory, but as shown on the Context page, the month-to-date indices are red as a tomato.

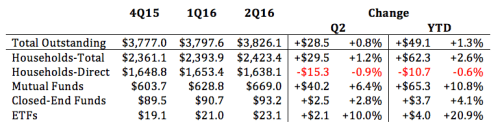

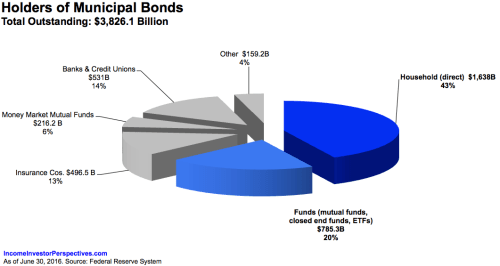

How can this be? Money is continuing to flow into the muni market–at least into mutual funds and ETFs, anyway.

The U.S. Treasury market has been much more volatile since Labor Day, and the muni market is not going to out-trade the Treasury market–at least not for long. In addition, the average trading flows in the last part of the year are typically lower than they are in the summer months, and new issue volume is picking up.

This is not to suggest that investors exit the muni market or hold off on putting money to work, but that they exercise caution. An old trader’s maxim comes to mind: “You make your money when you buy, not when you sell.”

Ugly is a Strong Word

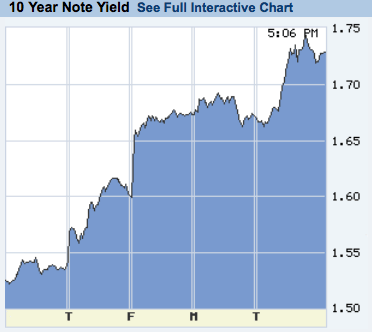

The chart below is from The Wall Street Journal’s Market Data Center, and shows the last 10 days of trading for the U.S. Treasury 10-year note. Note the gap up in yields from Thursday to Friday. If you’re a trader looking for capital appreciation, this is an ugly chart–unless you were short the market.

Perhaps adding to the negative pressure on bond prices, DoubleLine CEO Jeff Gundlach made headlines on Thursday with his comment that, “Interest rates have bottomed. They may not rise in the near term as I’ve talked about for years. But I think it’s the beginning of something and you’re supposed to be defensive.”

However, if you are an investor starved for income, an uptick in yields can be a good thing.

The crucial question, however, is how to react to this.

In the past, many investors have tried to time the market, and for years have been saying that they would wait for rates to go higher. While timing rates is nearly impossible, doing so also exposes investors to greater risks by leaving their portfolio unbalanced. Holding what should be a fixed income allocation in cash will not add any helpful diversification to the needed equity risks in a portfolio. As my friend Andy Martin has written in his excellent book, DollarLogic (see my review here), it is often better to reduce risk than it is to increase return and that to enjoy above-average long-term returns you need to focus on having smaller losses, instead of bigger gains.

So investors should be doing in here is exactly what Gundlach suggested in his comments: reduce duration.

If you need specific insight about ways to do that, take a look at these earlier articles on Using Duration as a Guide With Muni ETFs and on Van Eck’s MuniNation blog, Using Muni ETFs to Complement a Portfolio of Bonds and Muni ETFs in a Portfolio.

In addition, see my article today on Seeking Alpha, How Does a Bond Investor Get Defensive?

“Liquidity, Liquidity, Liquidity.”

SEC Commissioner Michael Piwowar spoke last week at FINRA’s Fixed Income Conference and had a lot to say. The speech is important reading for muni market professionals. Of particular relevance to advisors and investors is his summary of the current debate about bond market liquidity:

Some commenters are convinced that the reduction of dealer inventories and the high cost of capital resulting from post-crisis bank regulation mean that a single, large shock could cause the whole market to freeze up. Others see the way that fixed income markets have evolved over the past few years with large buy-side firms taking on some of the traditional roles of dealers, as well as fund managers stockpiling cash for the purpose of entering the market should there be a large sell off, and are persuaded that existing market dynamics are creating sufficient liquidity to withstand a large shock. With neither side able to provide conclusive evidence that a liquidity catastrophe either is, or is not, on the horizon, I am left with one conclusion: we all have more work to do. [emphasis added]

For market participants, that means dedicating resources to planning for future liquidity shocks and continuing to focus on innovations that may promote greater liquidity.

Importantly, note that he is not advocating for some regulatory “fix” for liquidity shocks, but that he advocates that everyone be better prepared for future shocks.

The Bottom Line

The caution flag is still flying, so here are a few thoughts of how to proceed.

The caution flag is still flying, so here are a few thoughts of how to proceed.

Curve: while there is a nice slope in the muni curve out to about 15 years, the duration at 15 years can be around 12 or higher–holding bonds to maturity can offset duration risk, but for most, it may be prudent to focus on shorter durations. In a recent look at muni ETF flows, that is where I saw most of the money going–into the funds with durations between 4 and 8. Buyers in the cash market may want to start by looking in that same range.

Credit: is the economy improving? If so, credit spreads should tighten, offsetting some of the price erosion caused by an increase in rates. It’s never a good idea to overload on any one source of risk, and credit risk gone bad can be especially painful to exit, but holding a modest amount of credit risk seems reasonable given the current environment, and can add some incremental income as well as diversification. If you’re going to consider going into non-investment grade, consider hiring a professional manager–either through an SMA, mutual fund or an ETF.

Structure: premium bonds should still be favored for their lower duration and higher cash flow. If rates do continue to tick higher, the higher cash flow will be available to reinvest at the higher prevailing rates.

Calls: rates could go lower, so beware of the total call risk in your portfolio. There are attractive opportunities right now for short call “kicker” bonds that would have higher yields to maturity if they don’t get called–but be sure that you are well compensated for that extension risk.

Products: muni bond mutual funds have had huge flows for months and months. (Muni ETF flows have also been positive, but the dollar amounts are much less. See the Context page for recent data.) If those flows stop, that could take a lot of demand pressure out of the market, further pressuring muni prices. If the flows reverse, even investors who remain in those funds could get hurt by fellow shareholders heading for the exits. Because of the liquidity and tax efficiency of ETFs, most muni investors should have at least a portion of their portfolio in muni ETFs.

Market Wisdom

Each issue, I’ll share one of my favorite investing quotes:

Predict yourself, not the market.

From DollarLogic by Andy Martin.

Let’s Catchup Together!

Munis have been added to the agenda for this year’s ETF.com Inside Fixed Income Conference!

Please come join me in Newport Beach this November for my presentation, “The Case for Muni Bonds: Active vs. Passive in the Puerto Rico Era.”

Please come join me in Newport Beach this November for my presentation, “The Case for Muni Bonds: Active vs. Passive in the Puerto Rico Era.”

Click here to see the complete agenda and to register.

What’s Going on With You?

If you ever have a question or a concern about the muni market and feel that it would be helpful for me to get involved, please do not hesitate to use me as a resource.

Have a great week, and thanks for reading,

Pat

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

©2016 Patrick F. Luby

All Rights Reserved

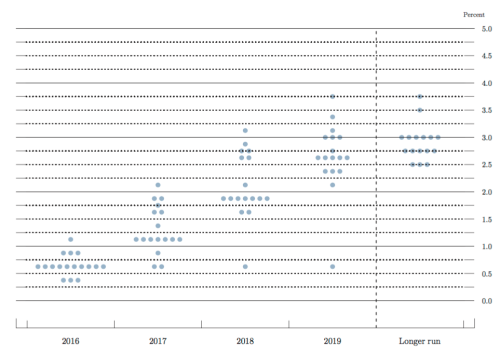

If you really want to accurately forecast rates, read my article on how to do it. Or, for a short-cut, ask The Magic 8-Ball. (If the answer is anything other than “Reply hazy, try again,” don’t rely on it.)

If you really want to accurately forecast rates, read my article on how to do it. Or, for a short-cut, ask The Magic 8-Ball. (If the answer is anything other than “Reply hazy, try again,” don’t rely on it.)

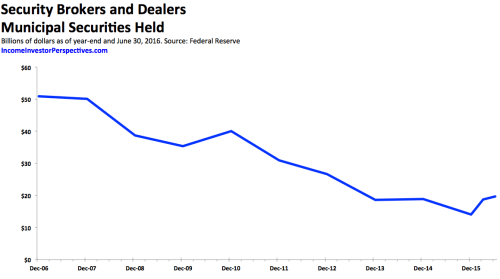

Source: Federal Reserve, September 16, 2016. Dollar amounts in billions.

Source: Federal Reserve, September 16, 2016. Dollar amounts in billions.

It was a painful day in the bond market (5-day chart of the U.S. Treasury 10-year note is below), so I’m just posting this in case you missed my article yesterday on Seeking Alpha, because it’s even more relevant now than it was yesterday.

It was a painful day in the bond market (5-day chart of the U.S. Treasury 10-year note is below), so I’m just posting this in case you missed my article yesterday on Seeking Alpha, because it’s even more relevant now than it was yesterday.

The caution flag is still flying, so here are a few thoughts of how to proceed.

The caution flag is still flying, so here are a few thoughts of how to proceed. Please come join me in Newport Beach this November for my presentation, “The Case for Muni Bonds: Active vs. Passive in the Puerto Rico Era.”

Please come join me in Newport Beach this November for my presentation, “The Case for Muni Bonds: Active vs. Passive in the Puerto Rico Era.” This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.