Summer Redemption Season

The $100 Billion Summer!

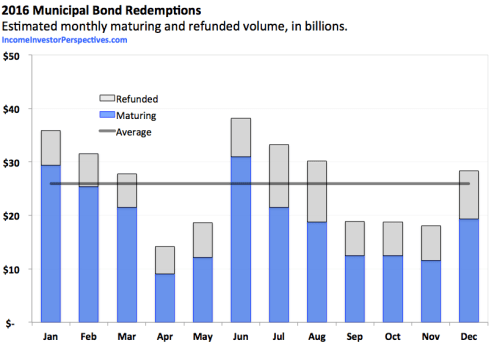

June has historically marked not only the end of school and the beginning of summer, but also the annual peak in municipal bond redemptions.

This year is expected to follow the same pattern, with $38.2 billion rolling off in June, $33.2 billion in July and $30.1 billion in August. (The monthly average this year is just over $26 billion.) Forecast redemptions include maturing bonds as well as bonds that have been advance refunded or current refunded and are expected to be called away.

For August, 80% of the $30.1 billion of redemptions are in the top 13 states:

- CA $6.6 billion

- TX $5.8

- NY $3.3

- MA $1.9

- VA $1.1

- FL $0.9

- WI $0.7

- NJ $0.7

- PA $0.7

- MD $0.7

- MO $0.7

- LA $0.6

- MN $0.6

The heaviest July redememptions break out like this (in billions):

- CA $4.1

- FL $3.2

- NY $2.7

- AZ $2.4

- WA $2.2

- PR $1.8 (scheduled for redemption, anyway…)

- IL $1.4

- NJ $1.3

- IN $1.3

- CT $1.0

- PA $1.0

- TX $0.9

- MD $0.9

- MA $0.9

Of the $38 billion in redemptions expected for June, about 80% were forecast in the top 16 states (in billions):

- NJ $6.6

- NY $5.7

- CA $5.6

- FL $1.8

- CO $1.6

- PA $1.4

- OR $1.3

- OH $1.0

The opportunity to reinvest principal is one of the benefits of holding individual bonds, but with current rates and economic uncertainty, many advisors and their clients may be uncertain about how to reinvest–or even if they will want to reinvest in municipal bonds.

In addition to all of the factors that should normally be considered (issuer, credit rating, coupon rate, maturity date, call features, par amount, etc.), the decline in secondary market liquidity and the increase in political risk need to be managed more carefully than ever. (My article, Bonds Are Not Stocks, touches on Political Risk as well as some other important risk considerations.)

If you or your client have bonds coming due (maturing or pre-refunded) in the next several months, here are some thoughts to consider:

- Changing asset allocation by using redeemed municipal bond proceeds to invest in another asset class will cause a shift in the overall portfolio risk profile, and should not be done unless called for by the investment plan. Generally speaking, market conditions should influence which bonds you buy–not whether or not you remain in the asset class.

- Don’t wait for the principal to be returned to you to consider what to do. Due to the volume of principal that will be seeking reinvestment, muni bond investors may find themselves competing with each other for a limited supply of appropriate bonds. Investors in high-tax jurisdictions with a preference for in-state double-exempt bonds may find their options even more severely reduced. Consider making provisions for reinvestment in advance of your bond’s redemption date.

- In some cases, it may make sense to consider selling bonds prior to the redemption date if a suitable replacement can be found. (Because short-term yields are very low, bonds with only a few months left until maturity may be able to be sold at a premium. While it will not often be optimal to realize a taxable gain on a municipal bond, if there are losses available to offset the gain, it may be worth considering. Consult with your tax advisor prior to finalizing any tax-related trades.)

- Pay attention now to the new issue calendar for appropriate issues that will settle after the maturity date of your maturing / refunded bond.

- As an alternative to individual bonds, you may wish to consider using a municipal bond ETF to maintain asset class exposure while waiting for a suitable replacement security. (To learn more about doing this, read my recent article about using duration as a guide to selecting municipal bond ETFs, available here.)

- If you expect a major liquidity event in your portfolio and the recent changes in the bond markets have you wondering if it is time to consider professional management for some or all of your municipal bond portfolio, read my article about The Benefits of Professional Management.

If you haven’t already, be sure to subscribe to receive additional articles and updates as soon as they are published. Your contact information will not be shared.

Income Investor Perspectives: Timely bond market insights for advisors and their clients

Summer Redemption Season

by Patrick Luby

March 29, 2016. Updated May 18, June 12 and July 12, 2016.

The opinions expressed and the information contained herein is based on sources believed to be reliable, but its accuracy or appropriateness is not guaranteed. This is not a recommendation to buy, sell or hold any of the securities or strategies mentioned. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Past performance is interesting but is not a guarantee of future results. Investments in bonds, and fixed income funds or ETFs are subject to gains/losses based on the level of interest rates, market conditions and changes in credit quality of bond issuers. Additional information available upon request.

©2016 Patrick F. Luby

All Rights Reserved.