Monday Muni Catchup

This week’s Muni Catchup:

This week’s Muni Catchup:

- Context

- Shifting Flows

- Hazardous Conditions

- Coming Attractions

- And don’t forget…

Context

Notice anything? Maybe like how U.S. Treasury rates have made a huge move? Ok, maybe not huge, and not big, but they have moved slightly higher, thanks to the chatter about the June FOMC meeting. And, did you also notice how the muni scale didn’t move as much?

Due to continuing very strong demand, the muni market is holding in pretty well. If the FOMC does move or the muni curve moves higher with the UST curve, market prices (and statement prices) can be expected to move lower. This means that there may be an opportunity in here for muni investors with bonds due in the next couple of months that could be sold at a premium to realize the gain now instead of waiting to receive par when their principal is returned. Generally speaking, taking taxable gains on munis is not often tax-efficient unless the holder has losses that can be used to offset against the gains. This is not tax or portfolio advice–consult with your own advisor before taking any action, but it could be worth reviewing your holdings and asking a few questions. This could be particularly worthwhile for investors with bigger portfolios and larger block size (say, 250M and larger). While awaiting the right bonds for reinvestment, don’t let your principal lay around doing nothing…muni ETFs can be used as a good liquid parking spot. If you haven’t used muni ETFs, read about How to Pick the Right Muni Bond ETF and also Duration as a Guide With Muni ETFs so that you can maintain a similar risk exposure.

While we are here (and since I have included the Muni / Treasury Ratio in the table above), let me add a comment about the Muni / Treasury yield ratios. Rather than thinking of the ratio as an indicator of rich / cheap, think of it as a barometer of the market. When the ratio is moving higher, it means “fair weather” in the Treasury market. (The Treasury market is outperforming the muni market.) When the ratio is falling, it means “fair weather” in the Muni market. Since most muni investors (whether individual bonds, mutual funds or ETFs) should be more concerned about how munis will help them reach or satisfy their goals, the fact that munis are extraordinarily cheap versus Treasuries should not–in and of itself–mean that an investor should be adding to their muni position. But the ratios are helpful as a gauge of how the muni market is trading relative to the largest and most liquid global market.

Finally, my apologies to those who are offended when the decimal points don’t line up (and you know who you are). Next time I run it this table, I’ll start working on it a little earlier so that you won’t be distracted by the non-aligned decimals.

Shifting Flows

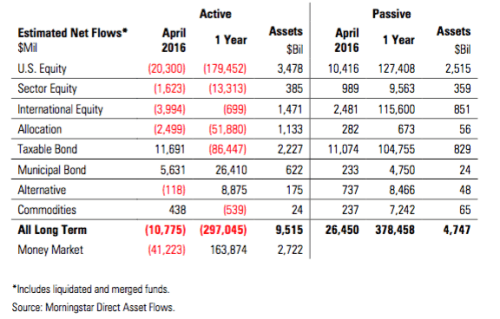

As noted in last Monday’s update, investors have been shifting many billions of dollars of assets into fixed income. And as I also noted last week, among municipal bond investors, mutual funds seem to have benefited from those flows by a much larger degree than ETFs have. A couple of days ago, the latest monthly U.S. Asset Flows Update from Morningstar Direct confirmed the observation:

Note that for the trailing 12-months, muni ETFs have attracted 15% of the total new muni asset flows, yet in April mutual funds grabbed 96% of the total muni flows.

If you have comments or insights about why the shift towards active, I’d like to hear from you.

Hazardous Conditions

Hazardous Conditions

Stay out of the water around Puerto Rico.

Our friend J.R. Rieger, Managing Director and Global Head of Fixed Income for S&P Dow Jones Indices put out an update on Sunday noting that there has been in bounce in the prices for Puerto Rico munis. This doesn’t mean that the coast is clear, but only that there are changing and potentially dangerous currents in the market for Puerto Rico bonds. Here’s the link to his article on Indexology.

Coming Attractions

What are you reading? More to the point, what are you thinking about?

There is a proliferation of summer reading lists, with everyone in the industry seeming to be telling everyone else what to read. I don’t know about you, but summer reading to me is Dirk Pitt, Ken Follett or Robert Ludlum. Maybe with a little Richard Feynman or George Weigel thrown in. Investing classics that are truly classics need to be read–and not just left for summer. So I do have a Summer / Fall / Winter / Spring reading list, but it doesn’t change very much from one year or season to the next unless there is something truly worthy of being added.

Last summer, rather than offering another reading list, I thought it would be more interesting to offer a list of things to think about, to help prepare for the back-end of the year. It was one of my most popular posts of the year.

So be on the lookout for my Summer Thinking List…Memorial Day and the unofficial start of summer are close, so I will be publishing an updated version of my list. This year, though, I will be publishing two lists: one for advisors, and one for investors.

And Don’t Forget…

Summer Redemption Season starts next week! Do you have bonds coming due on June, July or August? Do you have clients with bonds coming due? Should you roll them over into replacement bonds? Should you leave the principal in cash? Should you reallocate into another asset class? Should you use a muni bond mutual fund? Or an ETF? Over $100 billion in principal will be returned to investors in the next three months….where that money flows will have a big impact on the market. I updated the article to show the tops states for June redemptions. Be sure to read it.

The next Muni Catchup will be published Tuesday, May 31. Subscribe now to be notified when it is releasd.

Have a great week,

Pat

The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. The author does not provide investment, tax, legal or accounting advice–this is NOT investment advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Additional information available upon request.

This week’s Muni Catchup:

This week’s Muni Catchup: While most muni investors probably do not need to be worried about what’s going on with Puerto Rico bonds, everyone should be paying attention because the precedents being set now could affect how easy it will be for the next issuer that feels forced to choose which of their promises to honor.

While most muni investors probably do not need to be worried about what’s going on with Puerto Rico bonds, everyone should be paying attention because the precedents being set now could affect how easy it will be for the next issuer that feels forced to choose which of their promises to honor.