The last week of the quarter ended on a positive note for the bond market, with most yields finishing slightly lower. But, the trend across the quarter was choppy. Looking ahead, with decelerating fund inflows, a large pipeline of new issue supply and a lot of calendar distractions, caution remains the watchword.

The last week of the quarter ended on a positive note for the bond market, with most yields finishing slightly lower. But, the trend across the quarter was choppy. Looking ahead, with decelerating fund inflows, a large pipeline of new issue supply and a lot of calendar distractions, caution remains the watchword.

This week in The Muni Catchup:

- Q3 Recap

- Q4 Preview

- Don’t Forget About Money Market Reform

- Market Wisdom

- The Bottom Line

Q3 Recap

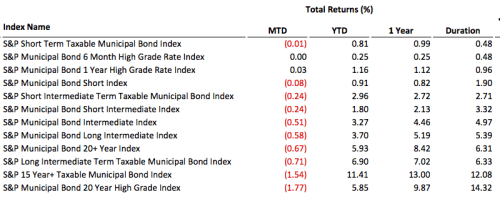

The last week of the quarter ended on a positive note, with most bond market yields finishing slightly lower. The trend across the quarter, however, has been choppy–note the negative monthly returns for the key bond market indices in the quarter. YTD total returns remain positive, but have been drifting lower because of the recent weakness in the bond market.

In the muni market, the heavy flow of redemptions in June, July and August ($38, $33 and $30 billion, respectively for this year) have traditionally lead to strong reinvestment demand–demand that has also tended to taper off after Labor Day. (This fall’s estimated redemptions: Sept $19B, Oct $19B, Nov $18B and Dec $28B.)

In the muni market, the heavy flow of redemptions in June, July and August ($38, $33 and $30 billion, respectively for this year) have traditionally lead to strong reinvestment demand–demand that has also tended to taper off after Labor Day. (This fall’s estimated redemptions: Sept $19B, Oct $19B, Nov $18B and Dec $28B.)

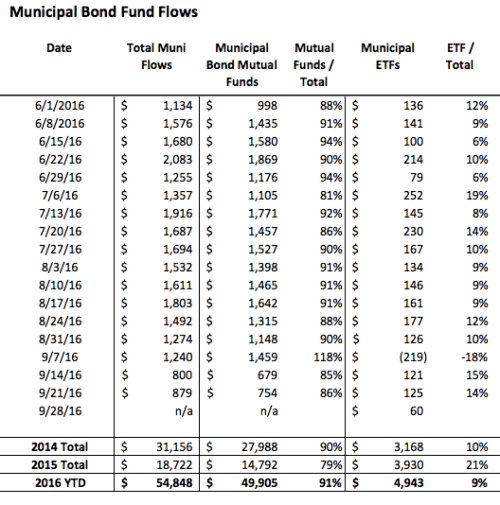

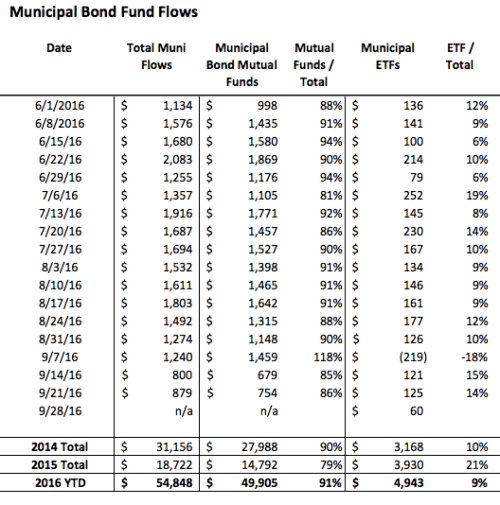

Using mutual fund flows as a proxy for overall demand tends to reinforce that view–note the peaks in recent total flows in June and July when redemption flows peaked. Note also the recent deceleration of inflows.

Flows in millions in dollars.

Q4 Preview

If demand is waning, supply is waxing. The Bond Buyer reports year-to-date muni issuance of $334 billion, a pace that could get close to or eclipse the record annual volume of $433 billion, set in 2010. September issuance totaled almost $36 billion, and future supply appears heavy, with $14.2 billion in deals scheduled just for this week.

Placing the heavy flow of new issues with investors will be challenged by the fourth quarter calendar, which is filled with distractions. Of the 13 weeks in the quarter, 5 of them will be shortened or interrupted by holidays or holy days. (Including this week.)

Important Dates

| 10/3 & 10/4 Mon & Tue |

Rosh Hashana |

|

| 10/10 Monday |

Columbus Day |

stocks open / bonds closed |

| 10/12 Wednesday |

Yom Kippur |

|

| 10/14 Friday |

effective date for Money Market Fund reform |

|

| 11/1 & 2 Tue & Wed |

FOMC meets |

|

| 11/2 & 3 Wed & Thu |

Inside ETFs: Inside Fixed Income 2016 |

|

| 11/8 Tuesday |

Election Day |

|

| 11/11 Friday |

Veterans Day |

stocks open / bonds closed |

| 11/24 Thursday |

Thanksgiving Day |

all U.S. markets closed |

| 12/13 & 14 Tue & Wed |

FOMC meets |

|

| 12/25 Sunday |

Christmas Day |

|

| 12/25 Sunday |

Chanakuh begins |

|

| 12/26 Monday |

Christmas Observed |

all U.S. markets closed |

| 12/30 Friday |

Last Trade Date of the year |

bonds close early |

If you subscribe to The Wall Street Journal, here’s a link to their economic calendar. The same economic calendar is also available on the MSRB’s EMMA website.

Market Wisdom

The portfolio with the least uncertainty may have an undesirably small “likely return.”

Harry M. Markowitz, Portfolio Selection

Don’t Forget About Money Market Fund Reform

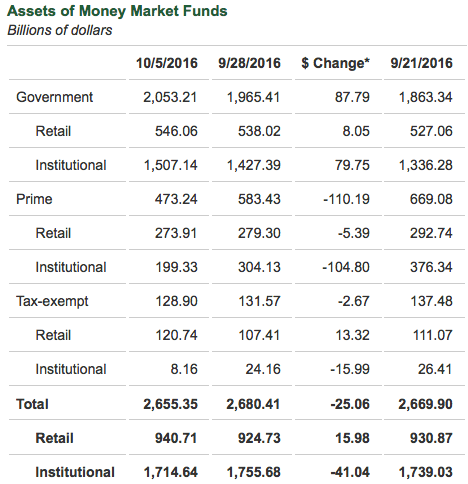

The muni market has been affected by the approaching October 14 deadline for the implementation of reforms to money market funds.

In addition to requiring a floating NAV for institutional funds, the regulations include provisions to potentially impose liquidity gates and fees on retail and institutional money market funds (but not governmental money market funds). Investors have responded by shifting assets within the fund types, drastically reducing the demand for some securities–including short-term municipal bonds but more importantly for commercial paper, which has been cited by some as the leading driver to the recent increase in LIBOR (see Context).

Since January 2015, prime and tax-exempt money market funds have seen a decrease in assets of $1.00 trillion, in response to the Securities and Exchange Commission’s 2014 money market fund reforms, which must be implemented by October 14. During the same period, government money market funds have seen an increase in assets of $974.77 billion, and total money market fund assets have remained consistently close to $2.7 trillion.

Source: ICI

While the shift in assets has been orderly so far, there may be some additional shifts seen in advance of the deadline for funds to implement the new regulations, which are summarized here. The table below is from ICI.

The Bottom Line

If the slackening of flows into funds continues and if the heavy new issue calendar persists, there may be some buying opportunities for investors. It is possible too, though, that the heavy supply will draw in institutional buyers who favor the large round-lots available in new issues. If the heavy supply is placed well, that would be a good sign of healthy demand from buyers.

Curve: Continue with the cautious stance as it pertains to maturity selection. Going out to 10-years picks up almost half of the available yield in the curve (see the Context page for details), but with much less risk. You don’t have to draw an artificial line in the sand right at ten years, but do be sure that you understand how duration risk can impact market valuations.

Credit: Holding a modest amount of credit risk is reasonable given the current environment, and can add some incremental income as well as diversification. If the economy continues to improve and pushes rates higher, that should also tighten credit spreads, which could offset some of the duration risk. But as always, if you’re thinking about adding non-investment grade bonds, consider hiring a professional manager–either through an SMA, mutual fund or an ETF.

Structure: Premium bonds remain favored for their lower duration and higher cash flow.

Calls: Beware of the total call risk in portfolios. There are attractive opportunities right now for short call “kicker” bonds that would have higher yields to maturity if they don’t get called–but be sure that you are well compensated for that extension risk. If you are going to accept call risk, be sure that you are getting paid to do so.

Products: Muni bond mutual fund and ETF inflows continue to be positive, but the pace has slackened. If the inflows stop, that could take a lot of demand pressure out of the market.

An interesting note here is that Morningstar will be combining their ETF and mutual fund rankings soon. If some of the muni bond ETFs get ranked highly in the combined universe, it will be interesting to see if there is a shift in the percentage of fund flows going to ETFs.

Sellers: Investors who will be selling should pay attention to the calendar and the overall tone of the bond markets–watch the 10-year U.S. Treasury for direction.

Have a great week, and thanks for reading. Please let me know if you have any questions.

Pat

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

©2016 Patrick F. Luby

All Rights Reserved

This week in The Muni Catchup:

This week in The Muni Catchup:

The last week of the quarter ended on a positive note for the bond market, with most yields finishing slightly lower. But, the trend across the quarter was choppy. Looking ahead, with decelerating fund inflows, a large pipeline of new issue supply and a lot of calendar distractions, caution remains the watchword.

The last week of the quarter ended on a positive note for the bond market, with most yields finishing slightly lower. But, the trend across the quarter was choppy. Looking ahead, with decelerating fund inflows, a large pipeline of new issue supply and a lot of calendar distractions, caution remains the watchword. In the muni market, the heavy flow of redemptions in June, July and August ($38, $33 and $30 billion, respectively for this year) have traditionally lead to strong reinvestment demand–demand that has also tended to taper off after Labor Day. (This fall’s estimated redemptions: Sept $19B, Oct $19B, Nov $18B and Dec $28B.)

In the muni market, the heavy flow of redemptions in June, July and August ($38, $33 and $30 billion, respectively for this year) have traditionally lead to strong reinvestment demand–demand that has also tended to taper off after Labor Day. (This fall’s estimated redemptions: Sept $19B, Oct $19B, Nov $18B and Dec $28B.)

The

The