Muni Catchup 9/6

Caution Flag is Still Flying

Caution Flag is Still Flying

Money is still flowing into the municipal market and year-to-date returns compare favorably with some equity indices. (See the Context page for details.) However, most municipal indices did not perform as well in August as they did in June or July, and the new issue supply is expected to pick up almost immediately now that Labor Day is past. Add in all of the political and Fed-related news headlines, and the next couple of months are likely to be even more “interesting” than the last couple of months have been.

How’s it going?

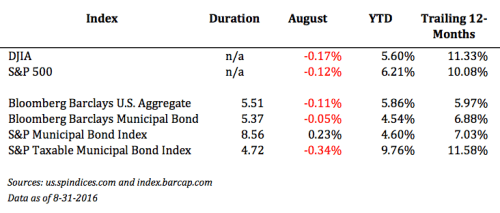

Here are some performance figures for selected indices. While the muni market has turned in a strong year-to-date total return performance, August was not as strong as prior months. Many of the S&P muni indices had positive returns for the month, but when month-to-month performance begins to slip, investors are advised to pay attention. It doesn’t necessarily mean sell. If it is in fact an indicator of future higher yields, that would mean lower market values for current fixed income holdings, but it could also mean higher investment returns for future purchases–welcome news in today’s yield starved market.

The potential for a softer market should of course also be reflected in investment selection–see my comments below in The Bottom Line.

| Index | Mod Dur | June | July | August | YTD | Trailing 12-Mos |

| DJIA | n/a | 0.80% | 2.80% | 0.13% | 7.03% | 13.45% |

| S&P 500 | n/a | 0.09% | 3.56% | 0.06% | 7.33% | 11.80% |

| Bloomberg Barclays U.S. Aggregate | 5.51 | 1.80% | 0.63% | -0.11% | 5.86% | 5.97% |

| Bloomberg Barclays Municipal Bond | 5.37 | 1.59% | 0.60% | -0.05% | 4.54% | 6.88% |

| S&P Municipal Bond | 4.72 | 1.63% | 0.02% | 0.23% | 4.60% | 7.03% |

| S&P Taxable Municipal Bond | 8.56 | 2.15% | 1.80% | -0.34% | 9.76% | 11.58% |

Data as of 8-31-2016. Sources: us.spindices.com and index.barcap.com

Three Seasons

Did you know that there are only 3 seasons? Of course you did, but perhaps you never realized it. I’m not talking here about the seasons as defined by the movement of the Earth, but the seasons as defined by human activity and how we actually live our lives each year: New Year’s until Memorial Day, Summer and then the time after Labor Day.

For many years, even though I had to do formal business plans based on quarters and years, my approach has been to schedule activities based on the three major parts of the year. I bring this up because this week we started a new season: the post-Labor Day “Fall” season, and the seasonal patterns in the muni market may surprise you because while most people may be expecting an uptick in business and client activity, in the municipal bond market, the “Fall” season for the last several years has not been the most active.

Municipal Bond Market Trading Activity

| Year | Daily Average | Spring | Summer | Fall |

| 2012 | Par Amount (billions) | $11.2 | $11.6 | $11.2 |

| Number of Trades | 38,505 | 39,359 | 37,322 | |

| 2013 | Par Amount (billions) | $11.3 | $11.8 | $10.6 |

| Number of Trades | 39,522 | 46,406 | 41,394 | |

| 2014 | Par Amount (billions) | $10.3 | $9.9 | $9.3 |

| Number of Trades | 37,471 | 34,611 | 32,945 | |

| 2015 | Par Amount (billions) | $9.9 | $8.6 | $7.0 |

| Number of Trades | 37,966 | 38,130 | 33,563 | |

| 2016 | Par Amount (billions) | $9.8 | $11.4 | ? |

| Number of Trades | 36,836 | 33,968 | ? |

Spring: First business day of the year until the last business day before Memorial Day. Summer: First business day after Memorial Day until the last business day prior to Labor Day. Fall: The day after Labor Day until the last business day of the year. Source: MSRB trade data from emma.msrb.org.

The heavy activity in the Summer months makes sense, given the heavy redemption flows in those months. For the last several years, however, note that the “Fall” (or post-Labor Day) season has actually seen lower activity levels than in the prior seasons. Of course, there are lots of reasons to speculate that activity this year may be heavier in the Fall: heavy new issue supply, the election, the Fed, the change in money-market fund regulations, etc., etc.

However, the slowing trend in returns and the recent historical precedent of lower trading activity in the “Fall” season contribute to my caution.

S’up?

Important news from around the muni market that you may have missed:

From the MSRB:

The Municipal Securities Rulemaking Board has officially published their new rule on mark-up disclosures.

In an effort to improve investors’ ability to assess the cost of transacting in municipal bonds, the Municipal Securities Rulemaking Board (MSRB) advanced a plan to require dealers to provide retail investors information about compensation dealers receive when buying municipal bonds from, or selling them to, investors.

The MSRB press release can be found here, the complete rule here, and if you are interested, you can also read the comments that I submitted to the MSRB here.

I believe that the vast majority of advisors and registered reps will embrace the rule–and in fact, many already make these disclosures.

However, the rule is complex, and will therefore run the risk of complicating the disclosures and the conversations that will have to go along with them. My guess is that in the interest of simplification, more assets will end up getting shifted out of individual bonds and into funds, ETFs or professionally managed solutions. In many cases, that could be a very good thing for investors, but it could also mean less secondary market support from the broker dealers, which could undermine secondary market liquidity. Stay tuned.

While we’re on the topic of mark ups, you may also find this recently updated report from S&P, “Unveiling the Hidden Cost of Retail Bond Buying & Selling” to be of interest.

From the SEC:

In order to strengthen ongoing disclosure of financial information in the municipal bond market, the Securities and Exchange Commission undertook the Municipalities Continuing Disclosure Cooperation Initiative (MCDC), and recently announced the first actions with issuers. (They had previously charged 72 underwriters with violations.)

The optics of the headline are worse than the reality of what is going on in the muni market. Keep in mind that there are over 60,000 issuers, and that the SEC charged 71 with not making proper and/or timely disclosures. The real take away in my mind is that this is a good reminder that self-directed investors must pay attention to how well the issuers that they’ve loaned money to are following through on their disclosure obligations. Most do a good job, but late (or non-existent) filings are a warning flag.

Market Wisdom

Each issue, I’ll share one of my favorite investing quotes.

Here’s what Alan Greenspan had to say about forecasting rates:

I think forecasting markets is very difficult, I would argue at the end of the day, probably with rare exceptions, almost impossible. But what you can do is measure the risks. And the risks essentially are different from somebody who is 30 years old and is saving for retirement or one who is 55. And I think those types of judgments are crucial and important for appropriate investment policies for retirement, and I don’t think you can generalize very far down the road.

Alan Greenspan, speaking as Chairman of the Federal Reserve, April 30, 2003.

The Bottom Line

With the caution flag up because of the expectation of a rate hike by the Fed, it seems sensible to de-emphasize maturity risk in favor of credit risk. (A diversified portfolio should have exposure to both, however. Reducing the weighting in one factor does not mean it should be dropped to a zero allocation.)

Call Features: Beware of how concentrated your call risk is–especially before you add any additional callable bonds to your portfolio. Also, do you have any bonds that are currently priced to a call but that would be at risk of getting priced to maturity if rates do go higher? If that happens, it could mean that you would then be subject to much higher interest rate risk because the duration for bonds is calculated based on the “priced to” date. This is what is referred to as extension risk, and investors should be on the lookout for it if rates do in fact begin to shift higher.

Coupons: All other things being equal, lower coupons mean higher duration and therefore higher interest rate sensitivity. With the unfavorable tax treatment of market discount on munis, investors who do not plan on holding bonds to maturity should be wary of buying par or discount bonds.

Taxable / Tax-Free: Investors who do not need the tax exempt feature of munis should compare the yields on taxable muni bond offerings versus comparably rated corporate bonds. Taxable munis can be hard to find, so if this makes sense for your situation, also consider a mutual fund of ETF.

Curve Positioning: Don’t pick a spot on the curve because of the yield, pick it because it adds the right risks to your portfolio. Pay attention to the duration (not just the maturity) whether you are looking at a bond, a fund or an ETF. The Context page provides some helpful numbers on the muni curve. Don’t go too short–unless you really need low duration; so that you don’t expose yourself to negative real yields, consider going far enough out the curve to at least match the rate of inflation.

Credit Positioning: If the economy improves, rates would be expected to move higher and credit spreads would be expected to tighten. Having some exposure to credit risk might make sense, but the lower the credit quality, the more important it becomes to have a well thought out investment process that includes ongoing due diligence. If you are tempted by the yields and returns in non-investment grade munis, exposure should be for only a minor portion of the fixed income allocation and should be professionally managed and broadly diversified.

What Are Your Concerns?

If you ever have a question or a concern about the muni market and feel that it would be helpful for me to get involved, please do not hesitate to use me as a resource.

Have a great week, and thanks for reading,

Pat

The leaves are falling already!

The leaves are falling already!

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request.

This is not investment advice. The opinions expressed and the information contained herein are based on sources believed to be reliable, but accuracy or appropriateness is not guaranteed. Past performance is interesting but is not a guarantee of future results. Investments in bonds are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer. Indices are not available for direct investment, although in some cases, there may be ETFs available designed to track some of the indices shown. The author does not provide investment, tax, legal or accounting advice. Investors should consult with their own advisor and fully understand their own situation when considering changes to their strategy, tactics or individual investments. Additional information available upon request. At the beach last week, the waves weren’t intimidating, but a stiff wind was pushing a very strong current, so the lifeguards had the yellow flag up–meaning it was ok to go in the water, but with caution. Some swimmers stayed on the beach while I was out riding waves–but even as an experienced and strong swimmer, I made sure that I was within the bounds of lifeguards’ markers.

At the beach last week, the waves weren’t intimidating, but a stiff wind was pushing a very strong current, so the lifeguards had the yellow flag up–meaning it was ok to go in the water, but with caution. Some swimmers stayed on the beach while I was out riding waves–but even as an experienced and strong swimmer, I made sure that I was within the bounds of lifeguards’ markers.